|

|

|

|

|

|

|

Click

on any strategy below:

|

|

|

| |

|

|

Saver's

Credit

New for

2002! The

Saver's Credit provides a nonrefundable

tax credit for contributions made

by eligible, low income taxpayers

to IRAs and qualified elective income

deferrals. The plan provides incentives

for lower income individuals to

save for their retirement through

available qualified plans. To qualify,

the taxpayer must have reached the

age of 18 by the close of the year

and cannot be a full-time student

or dependent of another. The credit

ranges from 10% to 50% of the first

$2,000 contributed to a qualified

plan during the year. The credit

gradually phases out as the taxpayer's

income increases and is fully phased

out for joint filers when their

gross income (AGI) reaches $50,000

($25,000 for single individuals

and $37,500 for those filing head

of household).

|

|

|

|

Minimum

Required IRA Distributions Reduced

The IRS released regulations in

2002 that substantially simplify

rules for required minimum distributions

(RMD) from IRAs and certain employer-sponsored

defined contribution plans.

|

There are new life expectancy

tables that allow smaller

distributions to be taken

over a longer period.

|

|

The calculation of the RMD

has been simplified by eliminating

certain variables

|

|

Rules regarding separate

accounts with different beneficiaries

have been clarified.

|

|

Some flexibility is now available

to change beneficiaries and

split accounts allowing the

heirs to retain more of the

tax-deferred income for a

longer period of time.

|

The IRS does not allow IRA owners

to keep funds in a Traditional IRA

indefinitely. Eventually, assets

must be distributed and taxes paid.

If there are no distributions, or

if the distributions are not large

enough, the IRA owner may have to

pay a 50% penalty on the amount

not distributed as required. Generally,

distribution begins in the year

the IRA owner attains the age of

70½.

The Minimum Required Distribution

Rules for IRAs have changed a number

of times in the past few years.

The rules included in this brochure

reflect the changes included in

the Final IRS Regulations, which

are effective for tax year 2003

but can be used in 2002.

BEGINNING DATE REQUIREMENT

IRA owners must take at least a

minimum amount from their IRA each

year; starting with the year they

reach age 70½.

If a taxpayer fails to take a distribution

in the year they reach 70½, they

can avoid a penalty by taking that

distribution no later than April

1st of the following year. However,

that means the IRA must take two

distributions in the following year,

one for the year in which they reached

age 70½ and one for the current

year.

If an IRA owner dies after reaching

age 70½, but before April 1st of

the next year, no minimum distribution

is required because death occurred

before the required beginning date.

MULTIPLE IRA ACCOUNTS

For purposes of determining the

minimum distribution, all Traditional

IRA accounts owned by an individual

are treated as one and the minimum

distribution can be taken from any

combination of the accounts. If

the owner chooses not to take the

minimum distribution from each account,

it is not uncommon for IRA trustees

to require written certification

that the owner took the minimum

distribution from other accounts.

DETERMINING THE DISTRIBUTION

The minimum amount that must be

withdrawn in a particular year is

the total value of all IRA accounts

divided by the number of years the

IRA owner is expected to live.

|

Determining Total Value:

The total value is based on

the sum of the value of all

the owner’s accounts at the

end of the business day on

December 31st of the prior

year. Generally, IRA account

trustees will provide this

information on the year-end

statements or on IRS Form

5498.

|

|

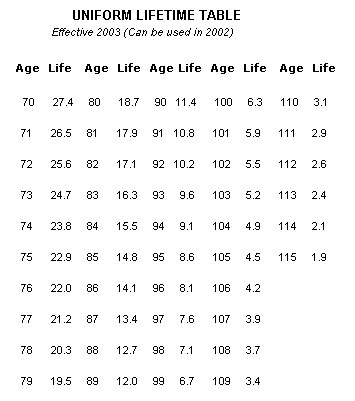

Determining the Distribution

Period: The IRS provides two

tables for use in determining

the IRA owner’s life expectancy

(referred to as “distribution

period” by the IRS). Generally,

IRA owners will use the “Uniform

Lifetime Table” to determine

their “distribution period.”

If the IRA owner’s spouse

is the sole beneficiary (on

all the IRA accounts), the

Joint and Last Survivor Table

may be used. However, the

Uniform Lifetime Table will

always produce the smallest

minimum distribution, unless

the spouse is more than 10

years younger than the IRA

account owner. Example: The

IRA owner is 75 and from the

“Uniform Lifetime Table,”

the owner’s life expectancy

is 22.9 years.

|

|

Determining Age: Use the

owner’s oldest attained age

for the year of the distribution.

Example: Suppose an IRA owner

takes a distribution in February,

when the owner’s age of 74,

but later in November, turns

75. For purposes of determining

the owner’s life expectancy,

the oldest attained age for

the year, 75 would be used

in computing the minimum distribution.

The same rule is used for

the spouse beneficiary, if

applicable.

|

|

Example: The IRA account

owner is age 75 and the owner’s

spouse, who is the sole beneficiary

of the accounts, is age 72.

Since the spouse is less than

10 years younger the IRA account

owner, the Uniform Lifetime

Table will produce the smallest

required distribution. From

the table, we determine the

owner’s life expectancy to

be 22.9. The owner has three

IRA accounts with a combined

value of $87,000 at the end

of the prior year. The minimum

distribution is $3,537 ($87,000

/ 22.9).

|

UNIFORM LIFETIME TABLE –

The following table is the one that

is generally used to determine the

Required Minimum Distribution from

Traditional IRA accounts. Not illustrated,

because of the size, are the Joint

and Survivor Life Table used to

determine RMDs when the sole beneficiary

spouse is more than 10 years younger

than the IRA owner and the Single

Life Table used for certain beneficiary

RMD determinations For table values

not illustrated, please call this

office.

TIMING OF THE DISTRIBUTION

The minimum distribution

computation determines the amount

that must be withdrawn during the

calendar year. The distributions

can be taken all at once, sporadically

or in a series of installments (monthly,

quarterly, etc.), as long as the

total distributions for the year

are at least the minimum required

amount.

Amounts that must be distributed

(required distributions) during

a particular year are not eligible

for rollover treatment.

MAXIMUM DISTRIBUTION

There is no maximum limit on distributions

from a Traditional IRA and as much

can be withdrawn as the owner wishes.

However, if more than the required

distribution is taken in a particular

year, the excess cannot be applied

toward the minimum required amounts

for future years.

UNDERDISTRIBUTION

PENALTY

Distributions that are less than

the required minimum distribution

for the year are subject to a 50%

excise tax (excess accumulation

penalty) for that year on the amount

not distributed as required.

Example: The owner’s required minimum

distribution for the calendar year

was $10,000, but the owner only

withdrew $4,000. The excess accumulation

penalty is $3,000, computed as follows:

50% of ($10,000 - $4,000).

If the failure to withdraw the minimum

amount or part of the minimum amount

was due to reasonable error, and

the owner has taken, or is taking,

steps to remedy the insufficient

distribution, the owner can request

that the penalty be excused. However,

the penalty must first be assessed

and then refunded by the IRS if

the request is approved.

NOT REQUIRED TO

FILE

Even though the IRA owner is not

required to file a tax return, they

are still subject to the minimum

required distribution rules and

could be liable for the under-distribution

penalty even if no income tax would

have been due on the under-distribution.

DEATH OF THE IRA

OWNER

If the IRA owner dies on or after

the required distribution beginning

date, a distribution must be made

in the year of death, as if the

IRA owner had lived the entire year.

If the distribution is after the

owner’s death, the minimum amount

must be distributed to a beneficiary.

BENEFICIARY DISTRIBUTIONS

When an IRA owner dies after beginning

the required distributions and the

beneficiary is an individual, the

beneficiary must begin taking distributions

the year after the IRA owner’s death

as follows:

Spouse as Sole Beneficiary: The

IRS permits a sole beneficiary spouse

far more options than it does other

beneficiates. When the spouse is

the sole beneficiary the spouse

has the following options:

|

Convert the IRA to their

own account, thereby delaying

additional distributions until

they reach age 70 ½.

|

|

Or, if already age 70 ½,

convert the IRA to their own

account and begin taking RMD

based on their attained age

using the Uniform Distribution

Table.

|

|

Treat the IRA as if it were

their own, frequently referred

to as recharacterizing the

IRA to a “Beneficial IRA”

and naming new beneficiaries.

The spouse must begin taking

minimum distributions in the

year following the owner’s

death based on their life

expectancy using the Single

Life Table. Distributions

from Beneficial IRAs are not

subject to the premature distribution

penalties. Later, after they

are no longer subject to the

premature distribution penalty,

the IRA can be converted as

their own and they can choose

to stop taking distributions

until age 70 ½.

|

The choice depends

on the surviving spouse’s financial

needs and goals and in most cases

requires careful planning.

Caution: The

sole beneficiary requirement is

not met if the beneficiary is a

trust, even if the spouse is the

sole beneficiary of the trust.

Other Individual

Beneficiaries: If the beneficiary

or beneficiaries include individuals

other than the spouse, then the

first required distribution is the

calendar year following the year

of the IRA owner’s death. Using

the Single Life Table, the post-death

distribution period used to determine

the RMD is the longest of:

-

The remaining life expectancy

of the deceased IRA owner using

the deceased’s attained age

in the year of death and subtracting

one for each year subsequent

year after the date of death.

-

The remaining life expectancy

of the IRA beneficiary using

the beneficiaries attained age

in the year of death and subtracting

one for each year subsequent

year after the date of death.

The beneficiaries’ remaining life

expectancy is determined using the

oldest beneficiary’s age as of their

birthday in the calendar year immediately

following the IRA owner’s death

or for those accounts that were

separated by the end of the year

after the year after death, the

age of each beneficiary. Where the

beneficiaries include the spouse,

account separation must be completed

by September 30th instead of year-end

to take advantage of the spouse

sole beneficiary provisions.

5-Year Option: A beneficiary,

who is an individual, may be able

to elect to take the entire account

by the end of the fifth year, following

the year of the owner’s death. If

this election is made, no distribution

is required for any year before

that fifth year.

The above rules apply only to distributions

where the beneficiaries are all

individuals and occur after the

IRA owner has begun or is required

to begin minimum IRA distributions.

For distribution options for non-individual

beneficiaries or for distribution

options where the IRA owner dies

prior to beginning the required

minimum distributions, please call

this office.

PLANNING CAN MINIMIZE THE TAX

Advance planning can, in many cases,

minimize or even avoid taxes on

Traditional IRA distributions. Often,

situations will arise where a taxpayer’s

income is abnormally low due to

losses, extraordinary deductions,

etc., where taking more than the

minimum in a year might be beneficial.

This is true even for those who

may not need to file a tax return

but can increase their distributions

and still avoid any tax. If you

need assistance with your planning

needs, please call this office for

assistance.

|

|

|

|

Parents

Should Encourage Roth IRAs For Their Children

The long-term benefits of tax-free accumulation

provided by Roth IRAs are hard to ignore.

Parents can do their children a real service

by encouraging them to establish a Roth

IRA at the first opportunity. A Roth IRA,

left untouched until retirement, will

ensure that your child has a substantial

nest egg.

Take for example a youngster, age 17,

who contributes $2,000 to a Roth IRA and

allows that single deposit to accumulate

untouched until retirement at age 65.

At a conservative 8% annual growth, the

Roth IRA will have grown to $80,421.

Consider what the result would be if that

same young person continued to deposit

$2,000 a year to their Roth IRA. Assuming

an 8% annual growth, the Roth IRA will

grow to $980,264 by the time they reach

retirement age of 65.

But keep in mind that children, like adults,

must have "earned income" to establish

a Roth IRA. Generally, earned income is

income from working, not from investments.

Earned income can include income from

a part-time job, summer employment, baby-sitting,

yard work, etc. The amount that can be

contributed to either a Traditional or

a Roth IRA is limited to the lesser of

earned income or $2,000.

Your children may balk at having to give

up their earnings, especially since their

focus at their age will not be on retirement.

But this is not an obstacle if parents,

grandparents or others are willing to

fund all or part of the child’s Roth contribution.

If the parents or others contribute the

funds, they need to keep in mind that

once the funds are in the child’s IRA

account, the funds belong to the child.

The child will be free to withdraw part

or all of the funds at any time. If the

child withdraws funds from the Roth IRA,

the child will be liable for any early

withdrawal tax liability.

|

|

|

Avoiding

Premature Traditional IRA Distribution

Penalties

You may encounter certain financial situations

making it necessary to withdraw funds

from your IRA account. Funds withdrawn

from a Traditional IRA are taxed at the

regular income tax rates AND are subject

to a 10% early withdrawal penalty if you

are under 59-1/2 years of age at the time

of the withdrawal. However, in addition

to death, there are exceptions to this

10% penalty when you meet certain conditions

or the funds withdrawn are used to pay

certain qualified expenses. But remember

even if you avoid the penalty with one

of the following exceptions, the withdrawal

is still taxable for regular tax purposes.

|

Higher education expenses such

as tuition, fees, books, supplies,

and equipment required for the enrollment

or attendance of a qualified student

at an eligible educational institution.

In addition, if the individual is

at least a half-time student, room

and board is a qualified higher

education expense.

|

|

First-time homebuyer acquisition

costs (within 120 days of the distribution)

for the main home of a first-time

homebuyer that is the taxpayer,

spouse, child, grandchild, parent

or other ancestor. The distribution

is limited to $10,000 and if both

husband and wife are first-time

homebuyers, they each can withdraw

up to $10,000 penalty-free.

|

|

Unreimbursed medical expenses,

that are not more than: 1) The amount

you paid for unreimbursed medical

expenses during the year of the

withdrawal, minus 2) 7.5% of your

adjusted gross income for the year

of the withdrawal.

|

|

Medical insurance premiums that

you made as a result of becoming

unemployed.

|

|

Disability - you are considered

disabled if you cannot perform any

substantial gainful activity because

of your physical or mental condition.

A physician must determine that

your condition can be expected to

result in death or to last for a

continued and indefinite duration.

|

|

Annuity distributions - if you

retire before reaching the age of

59-1/2, you can avoid the penalty

provided that the withdrawals are

part of a series of substantially

equal payments over your life (or

your life expectancy), or over the

lives (or joint life expectancies)

of you and your beneficiary. The

payments under this exception must

continue for at least 5 years, or

until you reach the age of 59-1/2,

whichever is the longer period.

|

|

The

foregoing is a brief synopsis of

the exceptions to the early withdrawal

penalty. The rules pertaining to

these exceptions are extensive and

you are cautioned to consult with

this office prior to making any

withdrawals to insure you qualify

under the more detailed requirements.

|

|

|

|

Self-Employed

Pension Plan Contribution Limits Increased

Tax laws provide for plans that allow

self-employed individuals to establish

retirement plans for themselves and

their employees, if they have any. Those

most frequently encountered are the

SEP (Simplified Employee Pension) and

Keogh Profit Sharing Plans. Even though

they are not IRAs, the SEP plans utilize

an IRA account as the depository for

the SEP plan contribution, thus minimizing

the administration requirements of the

employer but limited the contributions

prior to 2002 to 15% of earnings. The

Keogh plans, on the other hand, offer

both profit sharing and money purchase

plans. Prior to 2002, the profit sharing

plan contributions were limited to 15%,

but the money purchase plans or combination

of profit sharing and money purchase

plans allowed contributions of up to

25%.

The compensation limits for both of

these plans has been increased to 25%

of compensation for years beginning

in 2002. The following details the differences

between contributions for employees

and the amount allowed for the self-employed

individual.

|

Employees: Contributions

on behalf of an employee are currently

limited to the lesser of $30,000

or 15% of the employee’s compensation

(up to the compensation limit).

Beginning in 2002, this has been

increased to $40,000 or 25% of

compensation up to the compensation

limit. The compensation limit

for 2001 is $170,000 and increases

to $200,000 (adjusted for inflation)

in 2002.

|

|

Self-Employed Individual:

Under prior law, the contribution

to a SEP by an owner-employee

was limited to 15% of the net

profits for self-employment (13.0435%

of the net profits before deducting

the contribution itself). Beginning

in 2002, this contribution limit

has been increased to 25% of the

net profits from self-employment

(20% of the net profits before

deducting the contribution itself).

|

Under current law, Keogh

Money Purchase Plans provide for contributions

of up to 25% of compensation. However,

the annual contribution to a Money Purchase

Plan is mandatory while the contribution

for a Profit Sharing Plan is discretionary.

This essentially eliminates the need

for Money Purchase Plans, since a Profit

Sharing Plan provides for the maximum

contribution while making the contribution

discretionary.

Based on the limits, some employers

and self-employed individuals may wish

to alter their retirement plans. Please

call this office for additional details.

|

|

|

Pension

Start-Up Credit

New For 2002 ! This is a nonrefundable

income tax credit for 50% of the administrative

and retirement-education expenses for

any small business (less than 100 employees)

that adopts a new qualified defined benefit

or defined contribution plan (including

a Code Sec. 401(k) plan), SIMPLE plan,

or simplified employee pension ("SEP").

The credit is limited to 50% of the first

$1,000 of administrative and employee

retirement-education expenses in each

of the first three years of the plan.

|

|

|

Planning

Your Taxable IRA Withdrawals

Your age at the time you make a taxable

withdrawal from your Traditional IRA account

can make a big difference in the amount

of tax you will pay. Generally, there

are three periods within your lifetime

where different tax rules apply:

|

Under Age 59½ - If you withdraw

the IRA funds before you reach age

59 ½, you will pay tax and a 10%

early withdrawal penalty unless

you can avoid the penalty through

one of the several exceptions provided

in the tax law. Note: Some states

also have small early withdrawal

penalties.

|

|

Age 59½ to Age 70½ - During

this period you can make withdrawals

of any amount without penalty. You

are only subject to the income tax.

|

|

Above Age 70½ - After reaching

age 70 ½, you must begin taking

at least the required minimum distributions

or face the 50% excess accumulation

penalty.

|

The number one key to minimizing taxes

on IRA distributions is to match withdrawals

to tax years in which you are in a low

tax bracket or even have a negative taxable

income. Take for example a year when because

of illness, disability, unemployment,

large business losses etc. that your income,

less your deductions and personal exemptions,

leaves you with a negative taxable income

for the year. To the extent your taxable

income is negative, you could make a taxable

IRA withdrawal and avoid any tax on the

amount withdrawn, and even if you are

under 59 ½, you would only pay the small

early withdrawal penalty.

Generally, except as mentioned above,

if you are under 59½, your IRA funds are

not a good source of cash except in cases

of extreme need simply because of the

tax liability and penalties. But if there

are no alternatives, it may be possible

to avoid part or all of the penalties

by carefully planning the withdrawals

so that they qualify for one or more of

the early withdrawal penalty exceptions;

(1) amounts withdrawn to pay un-reimbursed

medical expenses, (2) amounts withdrawn

while qualifying as disabled, (3) amounts

withdrawn and used to pay for medical

insurance while unemployed, (4) amounts

used to pay higher education expenses,

(5) amounts up to $10,000 for the purchase

a first home, and (6) early retirement

amount withdrawn as an retirement annuity.

Taxpayers must meet certain criteria to

qualify for these exceptions, so be sure

to contact this office to make sure you

meet those qualifications before proceeding.

For retired individuals, receiving Social

Security benefits, planning IRA distributions

can also be beneficial. Social Security

itself is only taxable when ½ of the taxpayer’s

Social Security benefits added to the

taxpayer’s other income exceeds $25,000

($32,000 for a married couple filing jointly).

Once this threshold is reached, every

additional dollar of other income will

cause 50 to 85 cents of the Social Security

benefits to also become taxable. Therefore,

if a taxpayer’s other income is under

the threshold, it is generally good practice

to withdraw just enough taxable IRA funds

to bring the income up to the threshold

amount even if the funds are not needed

in that year. They can be set-aside for

a future year when they might be used

for some unplanned need or large purchase.

Retirees, with income that already puts

them over the Social Security taxable

threshold, should avoid large uneven withdrawals

that might push them into a larger tax

bracket one year and way below that tax

bracket change in other years.

Remember, once a taxpayer reaches 70½,

they must begin taking distributions equal

to or greater than the Required Minimum

Distribution, somewhat limiting planning

options. If you wish to explore any of

these or other tax saving techniques,

please contact this office.

|

|

|

Don't

Mix Required Minimum Distributions!

Taxpayers who have reached the age of

70½ and have qualified retirement plans

are generally required to take minimum

distributions from those plans annually.

Quite frequently, taxpayers have multiple

IRA accounts in addition to one or more

types of qualified plans.This gives rise

to a commonly asked question, "Must I

take a distribution from each individual

account?" For purposes of the annual required

minimum distribution, a separate distribution

must be taken from each type of plan.

However, a taxpayer may have multiple

accounts for each type of plan, which

for tax purposes are treated as one plan.

For example, you have three IRA accounts.

The three separate accounts are treated

as one for tax purposes, and the distribution

can be taken from any combination of the

accounts.

|

|

|

How

Taxable Distributions from a Roth IRA

are Determined

Withdrawals from a Roth IRA are tax-free

if the funds have been in the Roth IRA

for at least five years, and

|

The account owner is at least 59-1/2,

or

|

|

The funds are used for a qualified

first-time home purchase (up to

$10,000), or

|

|

The accountholder becomes disabled

or dies.

|

Suppose a taxpayer does not meet the

requirements for a tax-free withdrawal.

The funds contributed to the IRA are always

tax-free, because taxes were paid on those

funds before they were deposited. Only

the earnings would be taxable. Then the

question becomes which funds are withdrawn

first? Anticipating this question, the

IRS has established a set of “Ordering

Rules” which specify the sequence in which

funds are withdrawn. All Roth IRAs, regardless

of where they are deposited, are treated

as one for purposes of the “Ordering Rules.”

|

First from contributions until

all contributions have been withdrawn

(these funds would be withdrawn

tax and penalty-free);

|

|

Next from all converted (rollover

amounts) until all have been withdrawn

(these funds would be withdrawn

tax-free, but see acceleration clause

below);

|

|

Finally, from earnings (these funds

would be taxable, and subject to

the early withdrawal penalty when

the taxpayer is under 59-1/2 years

of age.)

|

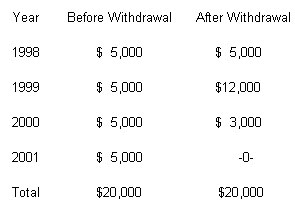

Acceleration Clause: If the taxpayer

converted funds from a Traditional IRA

in 1998 and elected to spread the tax

over four years and withdraws any of the

taxable portion of the converted funds,

then the taxability of the converted funds

is accelerated. This is best described

by example. Suppose a taxpayer converted

$20,000 from a Traditional IRA to a Roth

IRA and elected the special 4-year taxation.

$5,000 would be taxable each of the four

years. However, if the taxpayer withdrew

$7,000 of the $20,000 in 1999, the taxable

portion for 1999 would be $12,000 ($5,000

plus the $7,000 withdrawal.) In the year

2000, only $3,000 would be taxable (the

remainder of the $20,000) and nothing

would be taxable in 2001, the final year

of the 4 years.

Taxable IRA Income – Acceleration

Example:

|

|

|

Deemed

IRAs Can Lead To Tax Problems

The 2001 Tax Act created a way for taxpayers

to make both Traditional and Roth IRA

contributions through their employer’s

qualified plans. Under this program, employees

can make “volunteer employee contributions”

which can be designated as either Roth

or Traditional IRA contributions. However,

even though these IRA contributions are

being made through the employer’s “Deemed

IRA” program, you still must meet all

of the normal income qualifications and

contribution limits for either the Roth

or Traditional IRAs. If you do not qualify,

then the “Deemed contributions” would

be considered over-contributions that

would have to be corrected and could incur

some tax penalties. Therefore, before

becoming involved with a Deemed IRA program,

we strongly suggest you contact this office.

|

|

|

401(k) Contribution

Limits Increased

Many employers offer what are commonly

referred to as 401(k) plans named after

the tax code section that created the

plans. These plans allow employees to

defer part of their earnings for retirement.

Some employers offer matching contributions

that increase the attractiveness of

the programs.

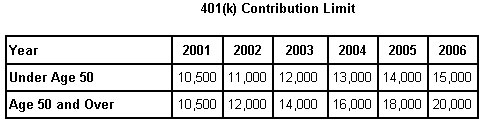

Beginning in 2001, the value of 401(k)

plans is enhanced even further by increasing

the general contribution limit and allowing

individuals over age 50 to make additional

contributions. The Act also allows individuals

to contribute amounts that are not excluded

from income to a 401(k) plan in a manner

similar to Roth IRA contributions.

The so-called “catch up contributions”

allow individuals age 50 and over to

make additional annual contributions

to 401(k) plans. These “catch-up” contributions

are $1,000 in 2002; $2,000 in 2003;

$3,000 in 2004; $4,000 in 2005 and $5,000

in 2006 and thereafter. Catch-up contributions

are exempt from the regular dollar limits

on deferrals provided that all 401(k)

plan participants are permitted to make

catch-up contributions.

The table below summarizes the limits

for 401(k) plans through 2006. If you

have additional questions about participating

in your employer’s 401(k) plan, please

call this office

|

|

|

Substantially

Equal Payment Exception

The decline in the stock market has adversely

affected the value of taxpayer’s retirement

investments. This decline in value of

retirement accounts has uniquely affected

taxpayers who have taken early retirement.

Generally, taxpayers who withdraw from

their pension plans including IRAs before

reaching age 59 ½ are subject to the 10%

early withdrawal penalty. However, taxpayers

who retire can avoid that penalty by using

a special exception that requires that

they take substantially equal payments

from their pension plan for a period of

time that is the longer of five years

or the until they reach 59 ½.

The substantially equal payments are computed

based on the value of the retirement account.

Those retirees who retired before the

decline in the market may have substantially

equal payments that are excessive for

account that have substanilly declined

in value and are depleting the plan to

a point that future recovery is threatened.

Because of this, the IRS has announced

that it will allow taxpayers to make a

one-time change to the Minimum Required

Distribution method, which is the same

method used by individuals who have reached

the age of 70 ½.

This one-time change will only allow a

taxpayer to switch to the Required Minimum

Distribution (RMD) method. Caution: switching

to the RMD may substantially reduce the

annual distribution and may not allow

an affected taxpayer to withdraw enough

to meet their current financial obligations

while they wait to meet the 5-year or

age 59 ½ rule. Many of them are counting

on the early pension withdrawals until

they start receiving their Social Security

or employer retirement. Once they switch,

they cannot increase or decrease their

withdrawal without violating the exception.

|

|

|

|

|

|